|

-----------------------

FRM P1 STUDY NOTES

-----------------------

TR18 - RISK MANAGEMENT AND FINANCIAL

INSTITUTIONS

|

·

Bank risks (regulation horizon for losses): credit risk (1

year), market risk (less than 1 year), operational risk (1 year)

·

Regulatory/economic capital:

capital required

(0.1% chance of loss > capital)/needed (typically less)

·

Deposit insurance (FDIC): %deposit insurance premium, moral

hazard (less with 2007 intro of risk-based premiums)

·

Investment banking: private placement (sell securities to a

small number of large institutional investors for a fee);

best efforts

public offering (sell to the public

for a fixed per share fee);

firm commitment

public offering (buy & sell to

the public for a profit);

initial public

offering (IPO) (initial

public issuance often at best efforts, sometimes through Dutch auction

process);

secondary

offerings (additional issuance often

target below current market price)

|

·

Conflicts of interest: separate banking activities (internal barriers);

done by US regulation from 1933 to 1999

·

Accounting: separation of trading book (marking to

market/model - M2M, proprietary trading) & banking book

(loans at cost + accrued interest)

·

Originate-to-distribute model: originating for a fee, selling and servicing the

loan for a fee; securitization (portfolio of loan packaging into

tranches); pooled & guaranteed by GNMA, FNMA, FHLMC

|

|

·

Insurance companies: contract to pay premiums to receive contingent

event payouts; life insurance (term, whole …), property-casualty insurance

(damage to property, legal liability), health insurance, pension

plan insurance; risks include reserves to meet payout falling, default

& liquidity of investments, business & operational risks

·

%deadY = conditional probability of dead during year

·

E(payouts) for Y1 to Y2 =

(%deadY1 + (1 -

%deadY1) * %deadY2) * coverage

·

E(premiums) for Y1 to Y2 = 1 + (1 - %deadY1) * premium

·

PV E(premiums) = PV E(payouts)

·

Loss ratio = payouts / premiums

·

Expense ratio = expenses(assess claims, selling) / premiums

·

Combined ratio = loss ratio + expense ratio

·

Operating ratio = combined ratio adjusted for investment income

|

·

Moral hazard: change in behavior because of insurance

availability (decrease it by deductibles, co-insurance provision, policy

limit)

·

Adverse selection: select/attract more bad risks than good because of

lack of info (decrease by more info, discrimination)

·

Mortality/longevity risk: live shorter/longer; could be hedged or insured

·

Capital requirements &

asset liquidity: property-casualty

> life insurance

·

Insurances contribute (%premium

income) to a guaranty association if insolvency of member occurs &

they are mostly state regulated

·

Defined benefit pension plan: pension defined, pooled, employer responsibility

·

Defined contribution pension

plan: pension not defined,

individual, employee responsibility

|

|

·

Net assets value (NAV) = (portfolio value) / (number of

shares); front-end/back-end load, annual fees (expense ratio)

·

Fund fees: (A plus %P) = %A + %P * (%R - %A) =

management fee + incentive fee

1.

Open-end mutual funds: shares bought from/sold to fund; valued once per

day (4pm); taxes based on fund assets

2.

Closed-end mutual funds: fixed number of shares outstanding traded on stock

exchanges; NAV > trade price (fund manager fees)

3.

Exchange-traded funds: for large institutional investors (mostly track

indexes); shares could be bought from/sold to the fund but also traded on

stock exchanges; exchange in cash or assets; value twice a day; lesser fees

|

4.

Hedge funds: less regulated, higher fees; incentive fee applicable

only over hurdle rate (clause) or previous loss deduction (high-water

mark clause); part/all of previous incentive fees retained to cover

current losses (clawback clause); after stat & fee adjustments

hedge fund returns = mutual fund returns

·

Hedge fund strategies: long/short (undervalued/overvalued) equity

(dollar/beta/sector/factor neutrality); dedicated short; distressed

securities (distressed debt can’t be shorted); merger arbitrage; convertible

arbitrage; fixed income arbitrage (relative value, market-neutral,

directional); emerging markets (local exchange, ADRs/underlying,

Eurobonds); global macro (disequilibria); managed futures

(commodities, technical/fundamental analysis)

|

T3R19 - OPTIONS, FUTURES AND OTHER

DERIVATIVES

|

1.

Exchange traded markets: smaller centralized market; more (liquid) standardized

contracts; less credit risk (exchange clearinghouse)

2.

Over the counter (OTC) markets: larger dealer (concentrated)

market over phone/computer; less (illiquid) customized, flexible, negotiable

contracts; more credit risk (bilateral or CCP)

|

1.

Forward contract: OTC obligation; Long = St - K, Short

= - Long

2.

Futures contract: exchange-traded obligation (symmetric return)

3.

Option contract: right at exercise/strike price for a cost (option

premium); American/European until/at maturity

Profit = Payoff -

Premium (asymmetric return)

Long Call holder

= Max(0, St - K) - C, short Call writer = - long Call

Long Put =

Max(0, K - St) - C, short Put = - long Put

|

|

1.

Hedgers: reduce or eliminate financial exposure; if long

exposure take short forward (fixe price) or hold put option (downside

insurance)

2.

Arbitrageurs: locking riskless profit in temporary mispricing

through offsetting

3.

Speculators: gain financial exposure; leverage with the use of

derivatives (only margin/premium as initial investment)

|

1.

Treasury Bonds: $100 000

2.

Eurodollars: $1 000 000

3.

S&P 500: 250X or 50X;

NASDAQ 100: 100X

4.

Gold: 100 troy ounces;

Silver: 5 000 ounces

5.

Copper: 25 000 pounds

6.

Corn, wheat: 5 000 bushels

7.

Crude oil: 1 000 barrels

|

|

·

Futures: quality of asset, contract size, delivery location,

delivery time, price quote & tick size, position & price (up/down)

limit, open interest, settlement price (closing period average)

·

Margin: initial also clearing (cash + interest or securities)/maintenance/variation

margin, mark-to-market, margin call

|

·

Orders: market, limit, stop-loss, stop-limit,

market-if-touched; discretionary (market-not-held), time-of-day, open (GTC),

fill-or-kill

·

Futures termination: delivery, exchange for physicals, cash-settlement,

close/reverse/offset

·

Normal/inverted futures market: in

contango/backwardation, increasing/decreasing futures prices with maturity at

point in time

|

|

1.

Short hedge: being short the futures & owning an asset

2.

Long hedge: being long the futures & willing to purchase an

asset in the future (anticipatory)

|

Hedging: (+) reduce risk

1.

(-) shareholders can hedge or

diversify (no need)

2.

(-) higher risks when competitors

do not hedge (profit volatility)

3.

(-) costs of inputs are passed to

prices (no need)

4.

(-) informational asymmetry in

loss/gain recognition (bad>good)

|

|

·

Basis = Spot Price - Futures Price, converge (zone) to 0; Strengthening:

larger (+), dS > dF, unfavorable to long; Weakening: smaller (-),

dS < dF, favorable to long

·

Basis risk (change in basis): interruption in convergence,

change in cost of carry model, imperfect correlation (maturity/duration,

liquidity & credit risk mismatch); derivative liquidity & basis risk

tradeoff

·

Rolling the hedge (stack & roll): close & replace

with later maturity contract; rollover risk is old + new basis risk

·

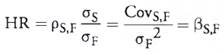

Optimal minimum variance hedge ratio (HR or MVR)

in cross-hedge: ; minimizes variation/risk; beta(dS,dF), slope of dS

against dF regression

|

·

Hedge effectiveness (coefficient of determination):

% %

·

Tailing the hedge adjustment (daily settlements):

HR = %HR * S / F

where %HR: beta

(%dS,%dF), slope of %dS against %dF regression

%HR = nbF/nbS * F / S (usual beta)

nbFc = %HR * S/F * nbS/ Fcs = %HR * Sv / Fcv

·

Target beta: (+) long, (-) short

nbFc = (betaTarget - beta) * (Sv / Fcv)

|

|

nbFc = HR * nbS / Fcs

|

HR = nbF / nbS

|

|

|

|

|

·

Close to risk free rates:

Treasury (too low because regulation, taxes), LIBOR, overnight &

term repo (implied), overnight indexed swap (OIS)

·

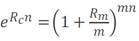

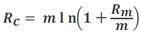

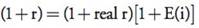

Discrete compounding expressed continuously

(equivalent):

& &

ln(a * b) = ln(a) + ln(b) & ln(a^b) = b * ln(a)

|

·

Zero spot rate, coupon rate, yield to maturity (YTM)

·

Par yield: c = (1 - endDF) * m / sum(DFs)

·

Forward rate: forward curve above/below is upward/downward spot

curve

·

Expectation theory F = E(S), market segmentation theory, liquidity

preference theory F = E(S) + premium

|

|

·

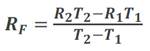

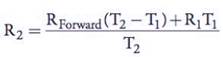

Forward rate agreement (FRA): RK & Rforward on (T2 - T1) period

compounding; based on LIBOR;

receiving/paying is

selling/buying the FRA

|

|

1.

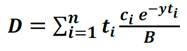

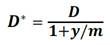

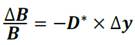

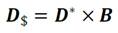

Macaulay duration (weighted-average maturity):

continuous

compounding = modified duration

2.

Modified duration: for non-continuous compounding with frequency m;

for small parallel yield shifts

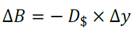

|

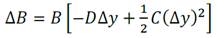

3.

Dollar duration: DV01 = 1 bp change in interest rate

4.

Convexity effect: in addition to duration

5.

Consol duration: 1/r

|

|

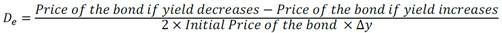

6.

Effective duration:

|

|

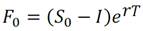

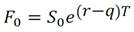

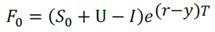

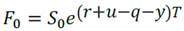

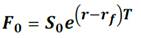

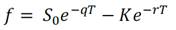

1.

Investment asset

forward/futures price:

or or

|

2.

Consumption asset

forward/futures price:

or or

|

|

·

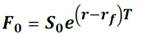

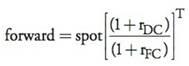

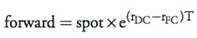

Interest rate parity (IRP):

FX quotation: [base currency]/[quote currency],

inverse of math

unit convention

|

·

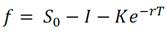

Value of long forward/futures:

or or

|

|

1.

Cost of carry model:

c = interest + storage (carrying) costs - cash

y = convenience yied

Contango: F0 > S0 when c > y (normal curve)

Backwardation: F0 < S0 when c < y (inverted curve)

Futures delivery

options: in the short position

interest if c > y deliver early, if c < y deliver late

·

Forward/futures prices: same for small maturities when uncorrelated with

constant (not volatile) interest rates (with positive correlation futures

> forwards)

|

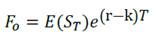

2.

Expectations model: in normal backwardation theory speculators are net

long & hedgers are net short; systematic risk impact

& &

Normal contango:

F0 > E(St) when

negative systematic risk & r > k

Normal

backwardation:

F0 < E(St) when

positive systematic risk & r < k

|

|

·

Accrued interest =

(days from last

coupon to settlement date) / (days in coupon period)

·

Cash/full/invoice/dirty price =

quoted/flat/clean

price + accrued interest (AI)

|

·

Day count conventions:

Treasury bonds (actual/actual),

corporate &

municipal bonds (30/360),

Treasury bills,

money market (actual/360)

(30 days: Apr, Jun,

Sep, Nov)

|

|

·

Cash to short = quote futures price * conversion factor (CF)

+ accrued interest (AI)

·

Conversion factor (CF) = (PV of bond - AI) / face value;

semi-annual bond

rounded down to 3 months at 6% YTM with maturity > 15 years (non-callable)

on first day of delivery month

·

Cheapest to deliver (CTD) bond: MIN(quoted bond price -

quoted futures price * CF);

if yields higher/lower

than 6%, deliver high/low duration bonds (low/high coupon, long/short

maturity);

if upward/downward

sloping yield curve, deliver long/short maturity bonds

|

|

·

Discount rate (T-bill quote) = 360 / actual * (100 - P)

annualized % of

face value

·

T-bond quote: 100-n/32nds

·

Eurodollar futures price quote: 100 - R (1 bp change = $25 change)

·

Eurodollar futures contract

price =

10000 * (100 - 0.25

* (100 - quote)) = 10000 * (100 - 0.25*R)

with continuous

compounding

|

·

LIBOR zero curve:

·

Duration-based hedge: for small parallel shifts in interest rates

nbFc = (DSTarget - DS) / DF * Sv / Fcv

|

|

|

|

|

·

Plain vanilla interest rate

swap: long (borrower, swap

payer) pays fixed & receives floating; short (lender, swap

receiver) pays floating & receives fixed; notional not exchanged;

today overnight indexed swap (OIS) rate used for discounting but LIBOR

to determine CFs (dual-curve stripping); swaps used to transform assets/liabilities;

dealer makes bid-ask spread on pair of offsetting swaps

·

Confirmation: legal agreement drafted by the International Swaps

& Derivatives Association (ISDA)

·

Absolute/comparative advantage: comparative advantage in lower diff; opposite for

other party;

total mutual gain = diff(FIXED) - diff(FLOAT) reduced by intermediary

spread (party gain divided by 2) between fixed rates; arbitrage should erode

differentials but they still exists because of creditworthiness (LIBOR +

adjusted spread)

·

Swap credit risk: when positive swap value, lower because of notional

amounts, higher in currency swaps

·

Other swaps: equity swap (capital gains & dividends,

CFs known at the end), swaption (option on swap), commodity swap,

volatility swap, exotic swaps

|

1.

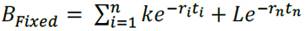

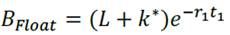

Interest rate swap: (series of FRAs)

& &

2.

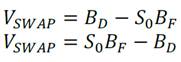

Currency swap: (series of foreign currency forwards)

fixed-for-fixed, fixed-for-floating (fixed currency +

interest swap), floating-for-floating (fixed currency + 2 interest

swaps); currency asset/liability transformation (no netting); currency swap

& &

S0 equates

principals at initiation (not at termination)

|

T3R21 - CENTRAL CLEARING

|

·

Exchange: product standardization (liquidity), trading venue

(price discovery), reporting services (price transparency)

·

Clearing: reconciling & resolving of contracts between

parties (after execution & before settlement) through margining M2M

(initial & variation margin) & through netting (offsetting

contracts/positions)

(1) Direct clearing: bilateral reconciliation of commitments, netting through payment of

differences

(2) Ring clearing:

reduce bilateral exposure & counterparty risk; could be

beneficial/detrimental/indifferent to parties involved

(3) Complete clearing: central intermediation by CCP/clearinghouse which is the

counterparty to both sides, loss sharing model

|

·

Derivatives classes (OTC by notional amount): interest rate >

foreign exchange > credit > equity > commodity

·

Systemic risk: chain reaction effect of counterparty defaults due

to initial shock

·

Special Purpose Vehicle/Entity (SPV/E): isolates financial risk; converts

counterparty risk to legal risk; shifts claim priorities under bankruptcy

·

Derivatives Product Company (DPC): highly graded bankruptcy remote

subsidiary providing external parties counterparty risk protection against

the failure of the parent company; extension to Credit Derivative Product

Companies (CDPCs) providing financial guaranties like monoline

issurance companies

|

|

·

CPP methods: allocate, manage and reduce counterparty risk

in bilateral market (conversion to liquidity, operational & legal risks);

reduce interconnectedness; provide more transparency; market

neutral matched book (conditional market risk); novation by

stepping in between parties & replacing 1 contract with 2 others (legal

process); multilateral offset; margining (initial/variation

margin); auctioning (defaulted member positions); loss

mutualization (guaranty/default fund); negative effect include moral

hazard, adverse selection, bifurcations & procyclicality

|

·

Bilateral markets methods: payment netting (also different currencies), close

out netting (termination with value offsetting)

·

CPP risks: clearing member default risk, M2M model

risk, liquidity risk, operational & legal risk

·

CPP lessons (last 40 years): problems from large price moves,

defaults, insufficient margins & default funds, liquidity delays; 3

have failed - Caisse de Liquidation (1974), Kuala Lumpur Commodity

Clearing House (1983), Hong Kong Futures Exchange (1987); 3 nearly failed

- Chicago Mercantile Exchange & Options Clearing Corporation (1987), BM&FBOVESPA

(1999)

|

T3R22 - FOREIGN EXCHANGE RISK

|

·

FX direct quote: DC/FC (indirect quote: FC/DC)

·

net FX exposure (long/short) = FXassets - Fxliabilities + FXbought -

Fxsold;

·

$FX gain/loss = $(net FX exposure) * %dFX(volatility), reduced

exposure by matching

·

Bank FX trading activities:

(1) international trade for customers as agent

(2) foreign real

& financial investments for customers as agent & for the bank

as principal

(3) hedging FX

exposure (defensive mechanism)

(4) speculation

(high FX risk)

|

·

On/Off balance-sheet hedging:

match A&L/use

forwards

·

Interest rate parity (IRP):

or or

·

Nominal interest rate = real interest rate + inflation

|

T3R23 - CORPORATE BONDS

|

·

Bond indenture: contract issuer/holder; corporate trustee

(bank or trust company) acts as fiduciary on behalf of investors

·

Bond categories: public utilities, transportations, industrials,

banks & finance companies, international/Yankee issues

|

·

Bond interest types:

(1) straight-coupon bonds: participating/income bonds pay more/less than

interest according to profit

(2) floating/variable-rate bonds

(3) zero-coupon bonds

·

Original-issue discount (OID) = face value - offering price

|

|

·

Bond security types:

(1) mortgage bonds:

first lien on issuer properties

(2) collateral trust bonds: backed by stocks, notes (personal property), bonds

(trustee holds collateral)

(3) equipment trust certificates: equipment owned by the trustee & rented to the

borrower

(4) debenture bonds: claims on all assets; subordinated bonds (bottom claim);

convertible/exchangeable bonds (convert in company/other common stock)

(5) guaranteed bonds: guaranteed by other company

|

·

Bond retirement types:

(1) call & refunding provision: fixed price call (buy all or part at fixed

price declining with maturity), make-whole call (PV of remaining CFs

if higher than par or par value); potential initial protection period;

(2) sinking fund provision: money applied to progressive partial retirement

through lottery redemption at specific price or through buys in the open

market

(3) maintenance & replacement fund (M&R): money applied to maintain the

value of the security backing the debt

(4) tender offers:

buying back part or all at fixed price/spread (not in indenture)

|

|

·

High yield bonds: speculative grade (bellow Baa/BBB-) junk bonds

issued as such or downgraded (story bonds, subordinated debentures, fallen

angels, M&A & LBO cases); deferred-interest (DIB)/payment

in-kind (PIK)/ step-up bonds pay no interest/additional

bonds/increasing coupon over an initial period, reset bonds

·

Issuer default rate = (defaulted issuers) / (all issuers)

·

Dollar default rate = (par value defaulted bonds) / (par value

outstanding bonds)

·

Cumulative default rate = cumulative(dollar default rate)

·

Recovery rate = (amount received) / (total obligation);

seniority improves

recovery rates

|

·

Credit risk: credit default risk (probability of default)

& credit spread risk (investor risk aversion change)

·

Event risk: corporate event impacting bond value

|

|