-----------------------------

CFA 2017 L3 STUDY NOTES

-----------------------------

SS1 | SS8 | SS9

| SS12 | SS14 | SS16 | SS17

SS1 CODE OF ETHICS

& STANDARDS OF PROFESSIONAL CONDUCT

R2 Guidance for Standards I-VII

|

Standards of professional conduct:

1.

Professionalism

A.

Knowledge of the law

B.

Independence & objectivity

C.

Misrepresentation

D.

Misconduct

2.

Integrity of capital markets

A.

Material nonpublic

information

B.

Market manipulation

3.

Duties to clients

A.

Loyalty, prudence & care

B.

Fair dealing

C.

Suitability: client-investment mandated

objectives/constraints

1.

Advisory role

2.

Managing role

D.

Performance presentation

E.

Preservation of confidentiality:

unless

1.

Illegal activities info

2.

Disclosure required by law

3.

Client permits disclosure

|

4.

Duties to employers

A.

Loyalty

B.

Additional compensation

arrangements

C.

Responsibilities of supervisors

5.

Investment analysis,

recommendations & actions

A.

Diligence & reasonable basis: (1) & (2)

B.

Communication with (prospective) clients:

1.

Disclose basic format,

general principles clients use

2.

Disclose significant limitations/risks

3.

Use reasonable judgment

in identifying important factors

4.

Distinguish between fact

& opinion

C.

Record retention

6.

Conflicts of interest

A.

Disclosure of conflicts

B.

Priority of transactions

C.

Referral fees

7.

Responsibilities as a CFA

Institute member/candidate

A.

Conduct as participants in CFA Institute programs

B.

Reference to CFA Institute, designation, program

|

SS8 ASSET

ALLOCATION & RELATED DECISIONS IN PORTFOLIO MANAGEMENT (1)

R17 Asset Allocation

|

1.

Strategic asset allocation (SAA): based on long-run capital market

expectations & IPS; long term policy target portfolio

2.

Tactical asset allocation (TAA): deviation from SAA or benchmark

to take advantage of perceived short-term (mean reverting returns to long

term level) opportunities (mispricing) in the market; increment

to SAA not replacement (small increment in return); undertaken infrequently

or regularly by monitoring the market and reacting

accordingly; active management (if value added > costs, internally

or by outside firm)

1.

Loss aversion: take greater risk to recover from a loss

2.

Mental accounting: identifying & immunizing individual goals;

more important less risk; pyramid

3.

Regret: bad feeling/disappointment/shame from

admitting bad decision; avoided if not recognized (loss)

4.

Fear of regret: avoid taking actions that could lead to

regret

|

Asset/liability management (ALM) approach: SAA based on liability

modeling (not asset-only approach)

1.

Static asset allocation: no link for asset allocation between different

time periods

2.

Dynamic asset allocation: multi-period view of investment horizon; Monte

Carlo simulation; unanticipated changes; difficult & costly;

ALM

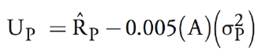

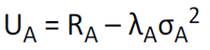

Utility risk-adjusted return: return, risk aversion score, variance

also 0.5 for decimal % also 0.5 for decimal %

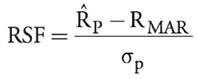

Roy’s safety-first measure (shortfall/downside risk):

return, min acceptable return, σ return, min acceptable return, σ

|

|

Asset classes:

1.

Contain similar assets

from a descriptive & statistical perspective

2.

Are not highly correlated

to provide diversification

3.

Should be mutually exclusive

(each asset only in one class)

4.

Cover majority of investable

assets (exhaustive)

5.

Have sufficient liquidity

for rebalancing

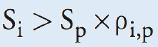

Adding a class: theoretical effects (risk, return,

correlation), practical effects (liquidity, legal, tax, political,

currency); a class could be added just for TAA; distinct classes: TIPS

(inflation), international investments (return) & alternative assets

(diversification); decision to add class/security:

if  Sharpe ratios, correlation Sharpe ratios, correlation

Asset allocation process:

1.

Determine IPS &

formulate capital market expectations

2.

Determine asset allocation (appropriate mix) & construct portfolio; TAA

also considered

3.

Monitor & revise allocation & portfolio

accordingly

CAL/CML allocation = risk free asset + tangency portfolio

(highest Sharpe ratio corner portfolio = market); risk

free lending (Rp < Rm) or borrowing if possible (Rm < Rp)

|

International assets:

1.

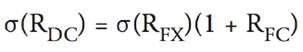

Currency risk: local market return (LCM) + local currency

return (LCR), if correlation +/- high/low volatility;

small impact over currencies & time; σ bonds < FX < stocks

2.

Political risk: monetary & fiscal policy, legal &

regulatory rules, FDI, capital flows

3.

Home country bias: overweight domestic investments; lack of familiarity;

match domestic assets/liabilities

Costs: high transaction costs (market impact),

withholding taxes & DTT issues, free-float issues,

inefficient market infrastructure; currency devaluation; crisis

contagion (high correlation, instead use conditional return correlation

depending on volatility level)

Opportunities (also emerging markets): long-run diversification

(decline over time, integration); foreign undervaluation; economic growth;

bonds less correlated than stocks

Segmented to integrated market: share price rise, expected return increase &

decrease, stand-alone risk decrease (variance down), efficiency increase,

diversification benefits decline (covariance up)

Corner portfolios: define segment adjacently with same assets

(shift when weights go +/0 or 0/+) & constant rate of

change of weights; include global minimum variance portfolio (GMVP); efficient

portfolios are linear combinations (interpolations) of adjacent

corner portfolios; 2-porfolio/(corner portfolio) theorem in

unconstrained/constrained (0 or positive weight) optimization

|

|

Asset allocation approaches

|

|

Mean variance optimization (MVO)

|

|

Resampled efficient frontier (REF)

|

|

Black-Litterman model (BL)

|

|

Monte Carlo simulation (MCS)

|

|

Surplus asset liability management (ALM)

|

|

Experience based techniques (EBTs)

|

SS9 ASSET

ALLOCATION & RELATED DECISIONS IN PORTFOLIO MANAGEMENT (2)

R18 Currency Management: An

Introduction

|

Exchange rate = (price currency)/(base currency);

buy or sell base currency in units of price currency; T+2; quotes: bid/ask

price, (receive less, buy)/(deliver more, sell) of price currency

Mark to market = PV of gain/loss

FX swap: roll over forward with spot; call option to buy

one currency = put option to sell other currency (out of/at/in the

money)

|

|

R19 Market Indexes & Benchmarks

|

5.

Index: represents the performance of a

specified group of securities

6.

Benchmark: reference point for evaluating

portfolio performance (indexes are often used as benchmarks)

Market index uses:

1.

Asset allocation proxies

(risk/return of classes)

2.

Investment management mandates

(specifying style ex-ante)

3.

Performance benchmark & portfolio analysis/attribution (evaluating

results ex-post, GIPS, legal compliance)

4.

Gauging market sentiments

5.

Design of index funds, ETFs, derivatives (passive

investment)

|

1.

Asset-based benchmarks: focus on assets/returns

& the ability of managers to meet/exceed them

2.

Liability-based benchmarks: focus on liabilities/payments

& the ability to meet/fund them (duration matching, relatively low risk)

Index construction tradeoffs:

1.

Completeness vs investability (liquidity & ownership

constraints)

2.

Reconstitution (addition/removal of securities) & rebalancing

(adjustment of weights) frequency to align characteristics vs low turnover

(transaction costs)

3.

Objective & transparent rules

vs subjective judgement

|

SS12

EQUITY PORTFOLIO MANAGEMENT

R23 Equity Portfolio Management

|

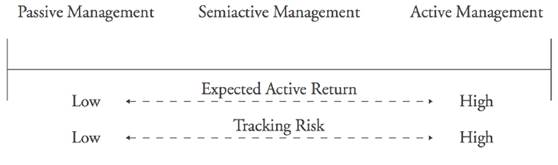

Equity (US 50%, EU 25% allocation):

1.

Passive management: indexing (minor)

2.

Semiactive/risk-controlled active management:

enhanced indexing; highest IR

3.

Active management: highest active return & risk

|

Information ratio (IR) = active return / tracking risk TE(V)

|

|

good inflation hedge (low

taxes, low competition)

|

|

|

|

|

|

Indexes:

1.

Price-weighted index: arithmetic average; adjustments for stock

dividends, stock (reverse) splits & addition/removal of stocks; biased

toward higher priced stocks

2.

Market capitalization value-weighted index: adjustments for stock issues/buybacks &

addition/removal of stocks; biased toward large cap, mature, overvalued

companies; (less diversified)

3.

Free float-adjusted market

capitalization value-weighted

index:

float-weighted, publicly available shares; biased

like market cap

4.

Equal-weighted index:

$ per

stock; periodic rebalancing; biased toward small-cap

Investment costs (high > low):

1.

Index mutual funds: admin

fees, liquidation impacts

2.

ETFs: more tax efficient, higher license fees

3.

Separated & pooled accounts: institutional,

securities lending

4.

Equity futures: finite

live (roll over), basket shorting/uptick rule

5.

Equity total return swaps:

cheap, tax advantages, TAA

|

Indexed portfolios (combinations possible):

1.

Full replication: < 1000, liquid stocks; self-rebalancing (except

for dividends & adjustments); low TE(V); index return -

admin fees, cash drag (for redemptions) & transaction costs (dividends

reinvestment, reconstitution & rebalancing)

2.

Stratified random sampling/representative sampling: index subset; multidimensional

market cap cell structure/matrix with representative stocks

(random sample) segmented by uncorrelated characteristics

(industry, size, P/E); TE(V) decrease with more cells

(finer divisions); can mimic concentrated positions

3.

Optimization approach: index subset; use of multifactor risk model

to match index factor exposures

accounts for factor dependence; use of objective

function to minimize TE(V) (lower than sampling); data overfitting;

historical bias; needs frequent exposure updates & rebalancing;

many solutions

|

|

Investing style:

1.

Value investing: low P/E, P/B; focus on numerator;

depressed earnings will rise as reverting to the mean; low turnover; substyles:

high dividend yield, low price multiples & contrarian

2.

Growth investing: high P/E, P/B; focus on denominator;

earnings growth; do better during economic contraction; high turnover; substyles:

consistent earnings growth & momentum (RSI)

3.

Market-oriented/core/blend investing: must outperform

broad market indexing strategies; substyles: value tilt, growth

tilt, growth at reasonable price (GARP), style rotation

Market capitalization-based investing: micro-cap, small-cap, mid-cap, large-cap

Style indices: value, growth, blend/neutral; holding-based

construction by assigning securities by category (no overlap) or by quantity

(market cap category split, overlap); buffering rules to reduce

reconstitution

|

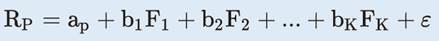

Style identification:

1.

Returns-based style analysis (RBSA): weights bi > 0,

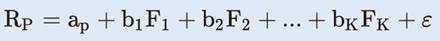

Sum(bi) = 1, (i > 0)

regression

against security indexes (well specified, mutually exclusive &

exhaustive); style fit = coefficient of determination R2

(unexplained variation = 1 - R2, error, selection return); construction

of custom/normal benchmark with bi weights (regression

coefficients)

2.

Holdings/composition-based style analysis (HBSA):

determination by averaging/comparing security selected characteristics

(dimensions);

2.1. For value:

high earnings volatility (cyclical firms), finance, utility, basic &

energy

2.2. For growth:

technology & health care

|

|

RBSA

|

HBSA

|

|

1.

Low cost & data, quick execution

2.

Could be misleading, many

solutions

3.

Focus on full portfolio

|

1.

Subjective, data intensive

2.

Detect style drift

quickly

3.

Focus on securities

|

|

Style box: (market caps) x (styles) matrix;

sub-detailed HBSA

Style drift: leads to outside exposure/expertise

problems

|

|

Socially responsible investing (SRI): ethical, social, religious; positive/negative

screens (look for/avoid); tilt toward small-cap growth stocks

|

|

1.

Long strategies: buy undervalued stock, avoid

overvalued; asymmetric active weight distribution (- bi limits)

2.

Long-short strategies: buy undervalued stock, sell

overvalued stock (2 alphas, long-short spread); symmetric active

weight distribution; can use market neutral strategy, pairs trade

(arbitrage) with beta = 0 & leverage

3.

Equitizing a market neutral portfolio (100/0 + 20/20):

cash + long/short

+ (long equity futures or ETFs)/cash; portable

alpha (transportable); seen as alternative investment

4.

Short extension/partial long-short strategy (120/20):

typically beta = 1; seen as long-only

substitute

Enhanced indexing strategies: stock-based/derivative-based

(yield & duration play, lower IB than stocks)

|

Short side price inefficiencies (overvaluation):

1.

Barriers: find security

lender

2.

Accounting manipulation to look better (performance)

3.

More buy than sell recommendations

by sell-side analysts:

buyers

> sellers; not anger large stockholders; firm management pressure

(cut off communications & investment banking/corporate finance deals,

lawsuits)

Sell disciplines (after tax): opportunity cost (substitution),

deteriorating fundamentals, valuation level, down-from-cost,

up-from-cost, target price

|

|

Fundamental law of active management:

Information coefficient (IC): knowledge depth, forecast/actual return

correlation

Investor breadth (IB): number of independent investment

decisions

|

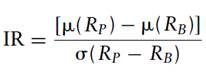

Information ratio:

|

|

Optimal allocation:

active return, risk aversion,

active risk (variance)

Higher aversion to active

than total risk:

1.

Pick possible active manager to produce possible

active return

2.

Take away positions from judged

passive index

3.

High active return needs focus

on highest active manager (less diversification)

1.

Core-satellite approach: active risk mitigated by core

(passive/enhanced investor benchmark) & active return added by the

satellites (manager portfolios); uncorrelated manager active

returns

2.

Completeness fund: combined with manager active

portfolios to make risk exposures similar to the investor benchmark;

neutralizes misfit risk; passive/semiactive indexing of fund &

regular rebalancing

|

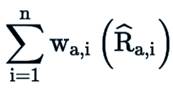

Active return:

|

Active risk (uncorrelated returns):

|

|

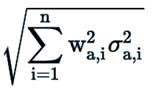

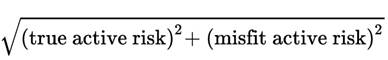

Total active return = true active return (A) + misfit active

return (S)

Manager true active return =

total return (P) - normal/neutral portfolio (B)

Manager misfit active return =

normal portfolio (B) - investor benchmark (M)

Total active risk =

True information ratio (IR) = (true active) / (true active risk)

Optimization objective: maximize total active return with given

level of total active risk with optimal amount of misfit risk (not

0)

|

|

Alpha & beta separation approach: systematic

risk exposure (beta) through low-cost index fund/ETF + portable

alpha through long/short strategy (more expensive); use of derivatives

if restrictions; clear separation of risks

1.

Buy-side (private) vs sell-side (public) research

2.

Top-down approach: macroeconomic

3.

Bottom-up approach: stock & industry level

|

Manager selection: quantitative (style, valuation) &

qualitative considerations

1.

Past performance (quant): evidence of superior results (not proof)

2.

Manager questionnaires: manager staff/organization;

investment philosophy/process; resources (research &

trading); performance; fees

3.

Fee schedules (quant): sliding ad valorem (AUM);

performance-based (more complicated, volatile, align interests if symmetric),

fee caps, high water mark provisions (cover negative return

first)

|

SS14

RISK MANAGEMENT

R25 Risk Management

|

Take necessary risks

(information/advantage to generate return), reduce/eliminate (hedge),

avoid unnecessary risks

Risk management process: continuous analysis & data update

1.

Identify & measure specific risk exposures

2.

Define specific tolerances (will/able to bear)

& adjust risk levels (upward/downward execution)

3.

Report risk exposures to stakeholders

(capital/risk budgeting)

4.

Monitor (limits) & take corrective actions (long-run

issues)

Risk governance (corporate governance): overall process to develop

& put a risk management system (infrastructure) into

use

1.

Transparent, clear

accountability, cost efficient, outcome effective

2.

Decentralized (business units); centralized (top-down,

aggregate diversified firm-wide risk, overall VaR, economies of

scale, ERM)

3.

Front office (trading & sales); back office (administrative,

transaction processing, record keeping, regulatory compliance, custodian

relations, STP)

|

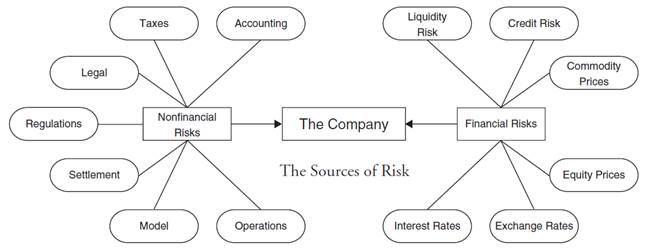

Financial risks (high > low):

1.

Market risk: interest rates, exchange rates,

equity prices, commodity prices

2.

Credit risk: debtor default on promised payment

3.

Liquidity risk: bid-ask spread, trading volume

(often not in valuation)

Non-financial risks:

1. Operational

risk: loss due to failure in company processes or from external

events

2. Model risk:

bad inputs & assumptions

3. Settlement

(Herstatt) risk: counterparty failure to deliver its obligation

(asset/payment) in a transaction

4. Legal/contract

risk: legal contract enforcement, litigation

5. Regulatory

risk: regulation

6. Tax/accounting

risk: laws/rules, taxes, reporting (IASB)

7. Sovereign/political

risk: government willingness/ability to pay (financial), political

conditions

Other risks: ESG risk, performance netting

risk (multimanager asymmetric fee), settlement netting risk

(challenged netting in liquidation)

|

|

|

|

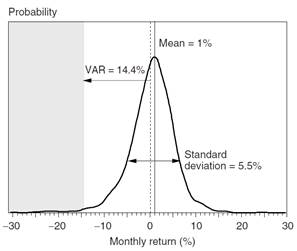

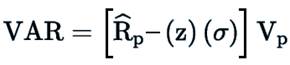

Value at Risk (Var): minimum expected $/%

value loss (to be exceeded) for a given probability

(confidence level) over a specified time period; downside left tail;

industry standard & part regulatory

·

|loss| >= |VaR|

·

z (score) = (x - μ)/σ

single tail: 5% is 1.65 σ, 2.5%

is 1.96 σ, 1% is 2.33 σ

·

n (periods): R/n & σ/√n; 250 days, 52 weeks, 12

months

1.

Analytical VaR method: parametric variance-covariance,

normal distribution; easy to compute/understand, mostly used

(positive z for 1 - Prob) (positive z for 1 - Prob)

many covariances, issues in leptokurtosis

& skewness (delta-normal method adjustment)

2.

Historical VaR method: nonparametric, rank/quantile past

data returns (sample); easy to compute/understand; data intensive, past

not future

3.

Monte Carlo VaR method: parametric computer simulation, rank/quantile

generated data returns; input assumptions (many solutions, GIGO,

overconfidence), difficult, computation intensive & expensive

VaR used in/with: capital/risk budgeting

(allocation to business units), projections backtesting, before/after

effect incremental VaR (IVaR), cash flow at risk (CFaR), earnings

at risk (EaR), tail VaR (TVaR) = average of losses beyond VaR,

credit VaR (CVaR), stress testing

|

Stress testing: focus on extreme adverse

outcomes

1.

Scenario analysis: different states, model

variables/(risk) factors; use of actual extreme & hypothetical

events; potential weaknesses/inability to accurately measure simultaneous

shifts, causal relations & correlation change effects on

factors

1.1. Stylized

scenarios (type involving at least 1 change in):

·

Interest rates: yield curve levels (parallel shifts

& twists, swap spreads), volatilities

·

Exchange rates: key FX levels, volatilities

·

Stock prices: equity index levels, volatilities

·

Commodity prices

2.

Stressing models (scenario analysis extension): range of

states

2.1. Factor push:

simple combination of (simultaneous) most disadvantageous

shifts in factors (independent)

2.2. Maximum loss optimization: math & computer modelling, sophisticated

worst combination of factors (dependent)

2.3. Worst-case scenario analysis: likely to occur

Credit risk (default probability, expected loss):

current (jump-to-default) vs potential;

cross-default-provisions (default on all & other creditors); linked to market

risk

|

SS16

TRADING, MONITORING & REBALANCING

R29 Execution of Portfolio Decisions

|

Market order: immediate; execution certainty, price uncertainty

Limit order: execution at the limit price or better that

expire; (partial/full) execution uncertainty, (price certainty)

|

Inside/market spread = quoted ask - quoted bid

Midquote = (quoted ask + quoted bid) / 2

Effective spread = |execution average price - midquote| * 2, leads

to price improvement or price/market impact; simple/volume-weighted average

|

|

1.

Brokered markets: search by agent (in illiquid markets); block

trading (upstairs market, listed on OTC 3rd market)

2.

Quote-driven/dealer markets: (closed-limit order book)

over the counter (OTC) market; bridge liquidity by sell-side

traders/market makers

3.

Order-driven markets:

3.1. Auction markets: natural liquidity by buy-side traders/investors;

competitive price discovery, periodic/batch vs continuous market

3.2. Automated auctions: same but computerized, Electronic Communication Networks (ECNs)

3.3. Electronic crossing networks: batch cross matching at midquote at fixed points in

time; no price discovery, low cost, anonymous, institutional (4th

market)

4.

Hybrid markets: ex NYSE - specialists, call/batch at open

& close

|

|

Dealer: sell-side principal, inventory, liquidity,

bid-ask spread, adverse selection risk

Broker: sell-side agent of buy-side,

commission

1.

Represent the order (principal-agent relationship)

2.

Find/be counterparty (principal trade)

3.

Supply market information

4.

Provide secrecy & discretion

5.

Provide other supporting services

(prime brokerage)

6.

Support the market process

|

Market quality (quantitative, qualitative):

1.

Liquidity: low costs - small bid-ask spreads, market depth,

resilience; factors - many buyers & sellers, diversity of opinions,

convenience, integrity

2.

Transparency: pre-trade (quotes, spread) & post-trade

(completed transactions) information availability

3.

Assurity of completion: clearing & settlement guaranties

|

|

Explicit costs: commissions, taxes, stamp duties & fees

Implicit costs: bid-ask spread, price/market impact

cost, missed trade opportunity cost, delay (slippage) cost;

require a benchmark

VWAP: share volume weighted average of execution

prices for a trading period (benchmark); better than midquote, open &

close prices

|

|

Implementation shortfall (IS) costs = (OC + DC + MC) + EC

IS for a buy [+] = (paper portfolio - gross actual portfolio) +

EC

= paper portfolio - net actual

portfolio

IS for a sell [-] = (gross actual portfolio - paper portfolio) +

EC

1.

OC: missed trade opportunity

cost (unrealized profit/loss)

2.

DC: delay cost (slippage

cost)

3.

MC: realized profit/loss

(market impact cost)

4.

EC: explicit costs

(commissions …)

|

Decision Price, Arrival Price, Execution Price,

Cancellation Price

|

DP

|

AP

|

EP

|

CP

|

|

|

Paper

portfolio

|

|

Not

filled

|

OC

|

|

Filled

|

DC

|

MC

|

Gross

actual portfolio

|

|

|

|

EC

|

Net

actual portfolio

|

|

|

|

|

|

|

|

|

Costs: total or per share $, %,

bp

Market adjusted IS = IS - beta(Rp) * Rm

|

|

|

VWAP

|

IS

|

|

Advantages

|

1.

Easy to understand

2.

Easy & quick to compute

3.

Good for comparing smaller

trades in nontrending markets

|

1.

Links trading to portfolio

management (cost/value)

2.

Useful in portfolio

optimization (performance)

3.

Recognizes time/price

tradeoff

4.

Allows cost attribution/decomposition

5.

No gaming

|

|

Disadvantages

|

1.

No account for delay or opportunity

costs

2.

Can be gamed

3.

Not good for substantial trades in trending

markets

|

1.

Requires extensive data

& analysis

2.

Unfamiliar to traders

|

|

Econometric models estimate trading costs (regression) nonlinearly

related to:

1.

Liquidity: trading volume & frequency, market cap, index

membership, spread, price level

2.

Trade size relative to available liquidity

3.

Momentum (up-down market)

4.

Risk (stock volatility)

5.

Trading style (aggressive, passive)

|

Usefulness in:

1.

Trading effectiveness: comparing actual (ex-post) costs to forecasted

(ex-ante) costs to assess execution quality

2.

Portfolio management: trade size/position determination (cost/value)

|

|

Traders

|

Motivation

|

Preference

|

Order Type

|

|

Information-motivated

|

Time sensitive information

|

Time

|

Market

|

|

Value-motivated

|

Security misvaluation

|

Price

|

Limit

|

|

Liquidity-motivated

|

Liquidity & reallocation

|

Time

|

Market

|

|

Passive

|

Liquidity & rebalancing

|

Price

|

Limit

|

|

Others: dealers, day traders

|

|

|

|

|

|

|

Trading focus/tactic

|

Strengths

|

Weaknesses

|

Motivation

|

|

Liquidity-at-any-cost

|

Quick, certain execution

|

High costs, info leakage

|

Information & liquidity

|

|

Costs-are-not-important

|

Quick certain execution at fair market

price

|

Loss of costs control

|

Various

|

|

Need-trustworthy-agent

|

Broker skill, time to obtain lower price

|

High commissions, info leakage

|

Not information

|

|

Advertise-to-draw-liquidity

|

Price, sunshine trades

|

High admin costs, front running

|

Not information

|

|

Low-cost-whatever-the-liquidity

|

Price

|

Uncertain timing, bad news

|

Value & passive

|

|

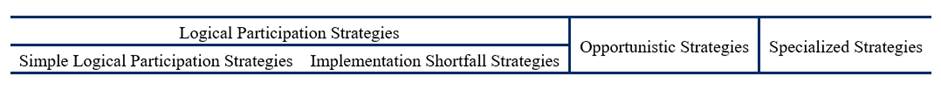

Algorithmic trading: automated quantitative systems using rules,

benchmarks & constraints to exploit market patterns (price/volume)

and minimize trading costs & risks

1.

Logical participation strategies:

1.1. Simple logical participation strategies: VWAP, TWAP, percentage

of volume (POV); small break up through time, minimize

market impact costs by matching or improving upon the benchmark

1.2. Implementation shortfall strategies: quick & early

(front-loaded), high market impact costs vs high volatility of delay

& opportunity costs tradeoff considering risk aversion;

objective function to minimize total cost & its variance;

full portfolio

2.

Opportunistic (participation) strategies: passive with

opportunistic liquidity seizing

3.

Specialized strategies: passive, hunter, market on close price

target, smart routing & others

Strategy choice driven by: relative(%) order size, bid-ask spread,

urgency of the trade

|

|

Best execution (prudence): use of best means to trade securities

1.

Linked to investment decision

(cost/value)

2.

Not known with certainty ex-ante, depends on

circumstances & parties

3.

Assessed ex-post over time

4.

Ongoing & integrated with relationships

& practices

|

Trade management guidelines:

1.

Processes: have formal policies & procedures

that assist in best execution

2.

Disclosures to (potential) clients periodically:

2.1. Information on trading techniques, venues, agents

2.2. Conflicts of interest related to trading

3.

Record keeping:

3.1. Compliance with policies & procedures

3.2. Disclosures

to clients

|

|

Buy-side traders:

1.

Should always act in the best

interests of clients (first)

2.

Have a fiduciary duty to

maximize portfolio value

|

Trust is more important now: lower commissions,

agency/explicit to adversarial/implicit cost shift; new tech

venue complexity & anonymity

|

SS17

PERFORMANCE EVALUATION

R31 Evaluating Portfolio Performance

|

Performance evaluation: fund sponsor/investment manager perspective;

feedback & control mechanism linked to IPS, effectiveness check

1.

Performance measurement

(quantification of return, what)

2.

Performance attribution

(sources of return, how)

3.

Performance appraisal

(raisons for return, why)

|

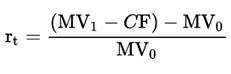

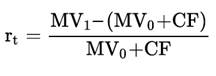

External CF: [+] contribution, [-] withdrawal

|

|

At end, MV1 after CF

|

At start, MV0 before CF

|

|

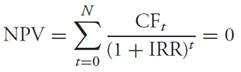

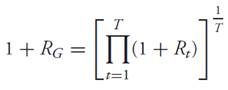

MWR (IRR): cash/return dependent, return on

average investment

TWR (GM): return per unit of money, data

intensive & expensive

LIRR: chain-linked MWR, approximate TWR

for CF < 10% of value & low volatility

|

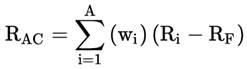

Portfolio = Market + Style + Active, A = (P - B),

S = (B - M)

|

|

Benchmarks (asset-based):

1.

Absolute (return objective, MAR, not investable)

2.

Manager universe (only measurable, ambiguous, not

specified/appropriate/investable, survivor bias)

3.

Broad market index (specified, measurable, unambiguous, investable)

4.

Style index (maybe ambiguous, maybe not appropriate, maybe not

accountable)

5.

Factor model-based (ambiguous, maybe not investable, expensive)

6.

Returns-based (maybe not appropriate, maybe not accountable)

7.

Custom security-based (maybe ambiguous)

|

Valid properties (SAMURAI):

1.

Specified in advance

2.

Appropriate (style/expertise)

3.

Measurable

4.

Unambiguous (IDs/weights)

5.

Reflective of current investment opinions (knowledge)

6.

Accountable (owned, accepted)

7.

Investable (replication)

|

|

Custom security-based (strategy) benchmark: expensive to

construct/maintain

1.

Identify manager’s investment process/style

2.

Select securities (including cash)

3.

Weight securities

4.

Review & adjust to process as needed

5.

Rebalance benchmark portfolio on schedule

|

Benchmark quality tests:

1.

Systematic bias: P = beta(1) * B; Corr(A, S) = 0; Corr(P - M, S)

= 1

2.

TE(V): low σ(A) < σ (P - M)

3.

Risk characteristics: same exposure to systematic sources of risk

4.

Coverage: high % ratio = (P intersect B) / P

5.

Turnover: low % ratio = (buy-sell of B) / B

6.

Active positions: small (number of) negative active weights

|

|

Hedge funds:

MV0 = 0

|

1.

Value added Rv = Rp - Rb

with separate/sum individual long/short positions

2.

Combine returns-based/holdings-based long &

short benchmarks

3.

Use of absolute return, style/manager

universe benchmarks & Sharpe ratio (but skewness)

|

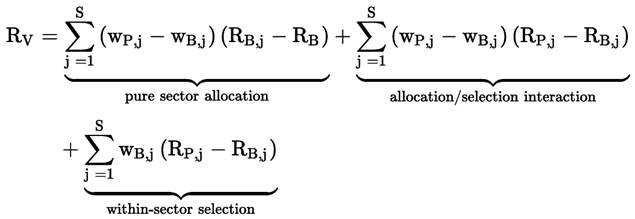

|

Macro performance attribution ($, % incremental):

1.

Net contributions

2.

Risk free asset

3.

Asset categories (SAA)

4.

Benchmarks (TAA, style bias, misfit return)

5.

Investment managers (active return)

6.

Allocation effects (plug)

|

Inputs: policy allocations; benchmark returns; fund

returns, valuations, external CFs

|

|

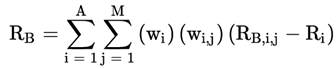

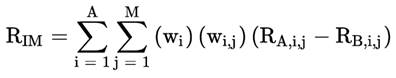

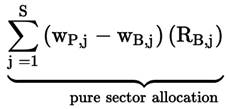

Micro performance attribution (%):

1.

Pure sector allocation:

weighting, [+] * [-] = [-]

2.

Allocation/selection interaction

3.

Within-sector selection:

stock picking

|

Value added return: Rp - Rb

|

|

Fundamental factor models in micro attribution (many solutions):

(x 2) (x 2)

1.

Identify fundamental/economic

factors generating systematic returns (market timing,

allocation/selection, sector rotation, company size, growth, leverage,

financial strength)

2.

Determine active exposures

= actual - normal from portfolio & benchmark

(normal portfolio) exposures for each factor at start

3.

Determine the active impact:

added return due to active exposures of the portfolio (not unexplained

return)

|

Fixed-income attribution (external + management):

1.

External interest rate effect: expected + unexpected return

on a passive default free bond benchmark

2.

Interest rate management effect: duration, convexity, yield curve

shape change

3.

Sector/quality effect (allocation/weighting)

4.

Security selection effect (picking)

5.

Trading activity effect (plug)

|

|

Risk adjusted performance appraisal measures (ex-post):

1.

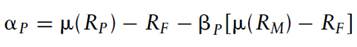

Jensen’s alpha (SML):

|

|

|

2.

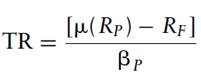

Treynor ratio (SML):

|

3.

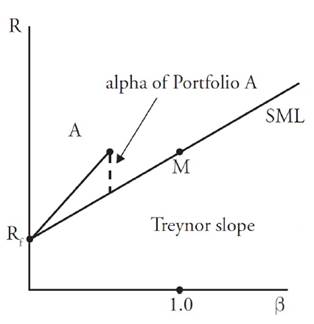

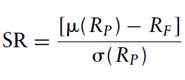

Sharpe ratio (CAL):

|

|

4.

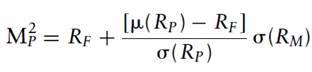

M2 measure (CAL):

|

5.

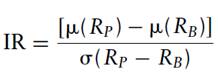

Information ratio (IR):

active return / active risk TE(V)

|

|

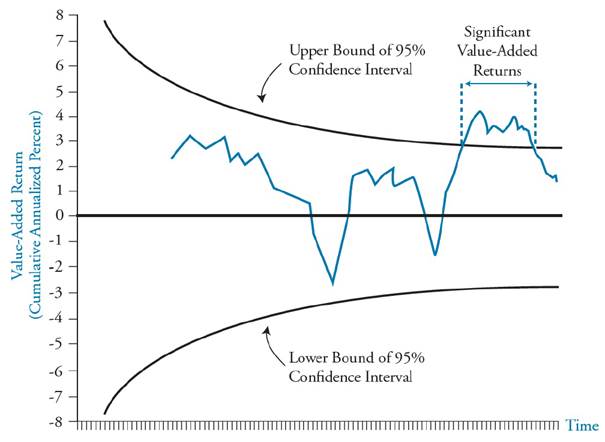

Manager Continuation Policy (MPC): manager continual monitoring &

periodic review

Value added return = portfolio - benchmark (independent,

normally distributed, consistent)

1.

H0: manager adds no value, Rv = 0 (null

hypothesis)

2.

HA: manager adds value (alternative

hypothesis)

1.

Type I error: rejecting the null when true,

keeping bad manager; P(T1)

> P(T2)

2.

Type II error: accepting (failing to reject) the null

when false (& HA true), firing (not keeping) good

manager; P(T2) > P(T1)

Quality control chart:

|

SS1 | SS8 | SS9

| SS12 | SS14 | SS16 | SS17

|